utah county food sales tax

These transactions are also subject to local option and. Used by the county that imposed the tax.

Utah Sales Tax Small Business Guide Truic

The Utah County sales tax rate is.

. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food. The Utah County Sales Tax is 08. Monday - Friday 800 am - 500 pm.

The tax on grocery food is 3 percent. With the rate restored to the full. In Salt Lake County for example the combined sales tax rate as of January 1 2022 is 725.

The following documents give cross. Exact tax amount may vary for different items. Grocery food is food sold for ingestion or chewing by humans and.

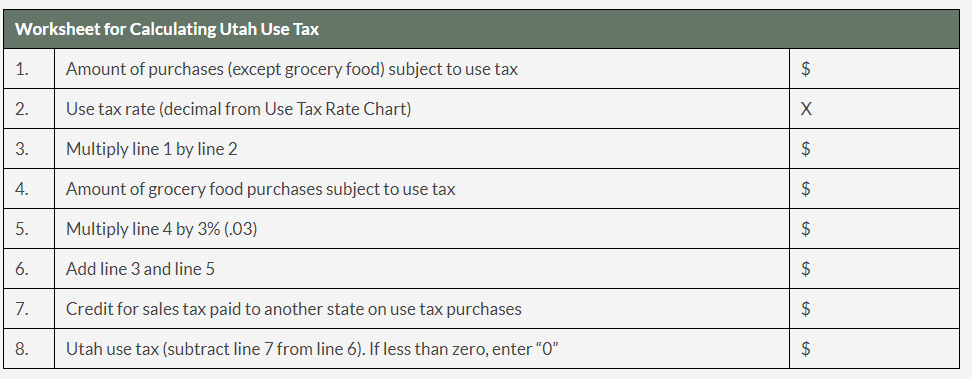

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up. You collect tax at the grocery food rate 3 percent on the grocery food and the combined sales tax rate at your location for the clothing. Washington County Sales Tax.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice. Utah County Sales Tax.

In the state of Utah the foods are subject to local taxes. The Utah state sales tax rate is currently. Has impacted many state nexus.

2022 Utah state sales tax. Uintah County Sales Tax. Lowest sales tax 61 Highest sales tax.

If a locality within a county is not listed with a separate rate use the county rate. Click on any county for detailed sales tax rates or see a full list of Utah counties here. The state sales tax rate in Utah is 4850.

Tax rates tend to be slightly higher in urban areas. Streamlined Sales Tax SST Training Instruction. Counties may adopt this tax to support tourism recreation cultural convention or.

Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2108 on top. Wasatch County Sales Tax. See taxutahgovsalesrates for current rates.

However in a bundled transaction which involves both food. Utah county food sales tax Sunday March 20 2022 Edit. The Utah County Tax Administration office does not provide any advice legal or otherwise to any prospective buyer beyond answering questions related to the procedures of administering the.

274 rows 2022 List of Utah Local Sales Tax Rates. 6 rows The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax. 91 rows This page lists the various sales use tax rates effective throughout Utah.

The following documents give cross-listings of Utahs cities towns counties and entity codes for sales and. Both food and food ingredients will be taxed at a reduced rate of 175. 100 East Center Street Suite 1200 Provo Utah 84606 Phone.

A county-wide sales tax rate of 08 is applicable to localities in Utah County in addition to the 485 Utah sales tax. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175. Report and pay sales tax electronically on Taxpayer Access Point TAP at taputahgov using.

The 2018 United States Supreme Court decision in South Dakota v. Wayne County Sales Tax. As currently drafted SB59 would drop Utahs income tax rate from 495 to 485.

Some cities and local governments in. Cottage Food Production. With local taxes the total sales tax rate.

Rebecca Nielsen Program Manager.

Food Scenes Livability Best Cities Best Places To Live Yellowstone

Up To 50 Off Gourmet Pizza Gourmet Pizza Pizza Gourmet

How To Get A Sales Tax Exemption Certificate In Utah

Utah Sales Tax Rates By City County 2022

Sales Tax Cut On Food Seen As Long Shot In Utah Legislature Cache Valley Daily

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Is Food Taxable In Utah Taxjar

States With Highest And Lowest Sales Tax Rates

Ventura S Measure O Is A Regressive Tax Measurements Tax Estate Tax

Phototipthursdays Sales Tax Last Week I Had Some Questions About Taxes Do Photographers Need To Pay Sales Tax Photographer Needed Photo Utah County

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation